This integration is powered by Singer's Stripe tap and certified by Stitch. Check out and contribute to the repo on GitHub.

For support, contact Support.

Stripe integration summary

Stitch’s Stripe integration replicates data using the Stripe REST API. Refer to the Schema section for a list of objects available for replication.

Stripe feature snapshot

A high-level look at Stitch's Stripe (v3) integration, including release status, useful links, and the features supported in Stitch.

| STITCH | |||

| Release status |

Released on August 29, 2023 |

Supported by | |

| Stitch plan |

Standard |

API availability |

Available |

| Singer GitHub repository | |||

| REPLICATION SETTINGS | |||

| Anchor Scheduling |

Supported |

Advanced Scheduling |

Supported |

| Table-level reset |

Unsupported |

Configurable Replication Methods |

Unsupported |

| DATA SELECTION | |||

| Table selection |

Supported |

Column selection |

Supported |

| Select all |

Supported |

||

| TRANSPARENCY | |||

| Extraction Logs |

Supported |

Loading Reports |

Supported |

Connecting Stripe

Stripe setup requirements

To set up Stripe in Stitch, you need:

-

Administrator permissions in Stripe. This is required to grant Stitch access to Stripe.

Step 1: Add Stripe as a Stitch data source

- Sign into your Stitch account.

-

On the Stitch Dashboard page, click the Add Integration button.

-

Click the Stripe icon.

-

Enter a name for the integration. This is the name that will display on the Stitch Dashboard for the integration; it’ll also be used to create the schema in your destination.

For example, the name “Stitch Stripe” would create a schema called

stitch_stripein the destination. Note: Schema names cannot be changed after you save the integration. - In the Lookback window field, enter the number of historical days’ worth of data you would like to replicate from the start date. The maximum lookback period is 600 days. This field is optional. Head to the Lookback windows and data extraction section to learn more about this.

Step 2: Define the historical replication start date

The Sync Historical Data setting defines the starting date for your Stripe integration. This means that data equal to or newer than this date will be replicated to your data warehouse.

Change this setting if you want to replicate data beyond Stripe’s default setting of 1 year. For a detailed look at historical replication jobs, check out the Syncing Historical SaaS Data guide.

Step 3: Create a replication schedule

In the Replication Frequency section, you’ll create the integration’s replication schedule. An integration’s replication schedule determines how often Stitch runs a replication job, and the time that job begins.

Stripe integrations support the following replication scheduling methods:

-

Advanced Scheduling using Cron (Advanced or Premium plans only)

To keep your row usage low, consider setting the integration to replicate less frequently. See the Understanding and Reducing Your Row Usage guide for tips on reducing your usage.

Step 4: Authorize Stitch to access Stripe

- Next, you’ll be prompted to sign into your Stripe account.

- A screen explaining what you’re authorizing will display. Note: Stitch will only ever read your Stripe data, and cannot create charges or any other records in Stripe.

- Click Sign in with Stripe to connect.

- Sign into your Stripe account.

- After the authorization process is successfully completed, you’ll be directed back to Stitch.

- Click All Done.

Step 5: Set objects to replicate

The last step is to select the tables and columns you want to replicate. Learn about the available tables for this integration.

Note: If a replication job is currently in progress, new selections won’t be used until the next job starts.

For Stripe integrations, you can select:

-

Individual tables and columns

-

All tables and columns

Click the tabs to view instructions for each selection method.

- In the integration’s Tables to Replicate tab, locate a table you want to replicate.

-

To track a table, click the checkbox next to the table’s name. A blue checkmark means the table is set to replicate.

-

To track a column, click the checkbox next to the column’s name. A blue checkmark means the column is set to replicate.

- Repeat this process for all the tables and columns you want to replicate.

- When finished, click the Finalize Your Selections button at the bottom of the screen to save your selections.

- Click into the integration from the Stitch Dashboard page.

-

Click the Tables to Replicate tab.

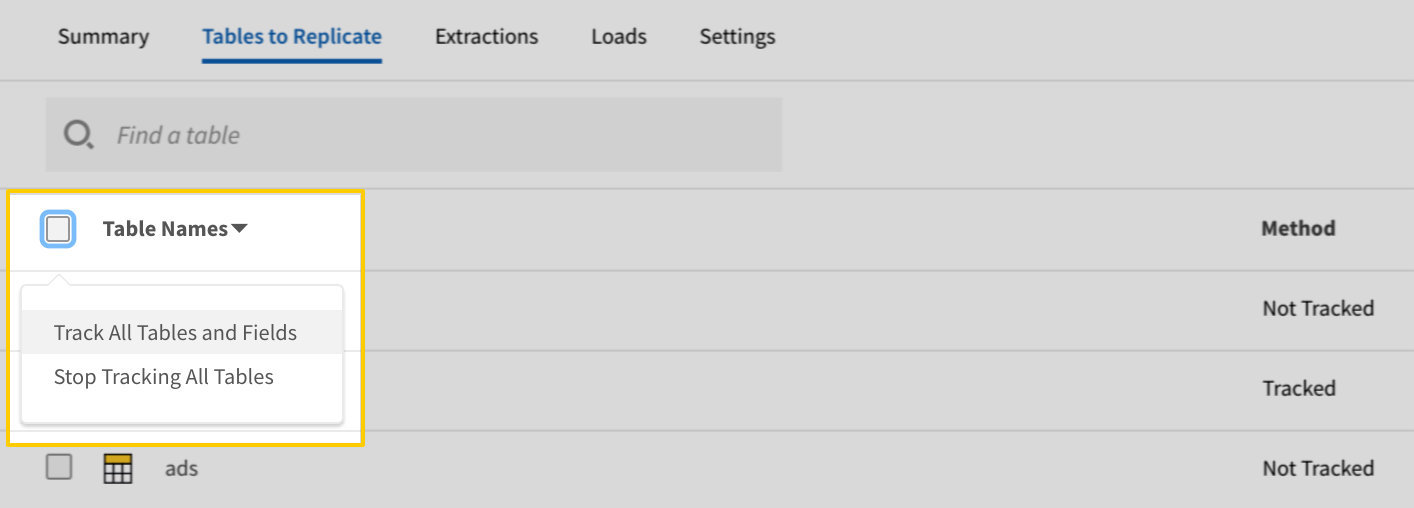

- In the list of tables, click the box next to the Table Names column.

-

In the menu that displays, click Track all Tables and Fields:

- Click the Finalize Your Selections button at the bottom of the page to save your data selections.

Initial and historical replication jobs

After you finish setting up Stripe, its Sync Status may show as Pending on either the Stitch Dashboard or in the Integration Details page.

For a new integration, a Pending status indicates that Stitch is in the process of scheduling the initial replication job for the integration. This may take some time to complete.

Initial replication jobs with Anchor Scheduling

If using Anchor Scheduling, an initial replication job may not kick off immediately. This depends on the selected Replication Frequency and Anchor Time. Refer to the Anchor Scheduling documentation for more information.

Free historical data loads

The first seven days of replication, beginning when data is first replicated, are free. Rows replicated from the new integration during this time won’t count towards your quota. Stitch offers this as a way of testing new integrations, measuring usage, and ensuring historical data volumes don’t quickly consume your quota.

Stripe replication

Events table replication

Stripe will only provide 30 days of historical event data for the events table. Refer the the Stripe docs for more information about the events table.

Objects and events

In the Stripe API, there are two concepts:

- Objects, which are items like charges, invoices, customers, etc.

- Events, which are changes to objects. For example: An invoice being created, or its status going from

drafttoopen.

Whenever an object is created or updated in Stripe, a corresponding event is created. Because Stripe creates and updates object records in this way, there are two types of tables in Stitch’s Stripe integration:

- A table for events, which contains all events that have occurred for Stripe’s supported event types. This table acts as a history for an object record, showing how it has been changed over time.

- Tables for objects, which contains the latest version of records. These are tables like

customers,charges,invoices, etc.

Note: Updates based on events is only applicable to the type of object the event is for. For example: If a dispute object is updated, only the corresponding record in the disputes table will be updated. The related charge in the charges table will not be updated. To retrieve related data for different objects, you’ll need to use the events table. Refer to Stripe’s documentation for info about event types and the objects they describe.

Example event and object data replication over time

In the image below is an example of how records for the events and invoices tables will look as an invoice changes over time. Click the image to enlarge.

Lookback windows and data extraction

When Stitch runs a replication job for Stripe, you can use a configurable lookback window of up to 600 days to query and extract data for your tables. A lookback window is a period of time for attributing shared files and the lookback period after those actions occur.

While Stitch replicates data in this way to account for updates to records made during the lookback window, it can have a substantial impact on your overall row usage.

In the sections below are examples of how lookback windows impact how Stitch extracts data during historical and ongoing replication jobs.

For historical and full re-replications of Stripe data, Stitch will query for and extract data newer than or equal to the date defined in the Start Date field in the Integration Settings page.

The Start Date, in conjunction with the Lookback Window, defines the minimum date Stitch should query for when extracting historical data. This is calculated as:

Start Date - Lookback Window = Minimum Extraction Date

Example

During the initial set up, the Lookback Window and Start Date settings are defined as:

- Lookback Window: 600 days (default setting)

- Start Date:

07/03/2017, or2017-07-03 00:00:00

To account for the Lookback Window, Stitch would calculate the Minimum Extraction Date value as: 2017-07-03 00:00:00 - 600 days = 2015-11-11 00:00:00

If you were to write a SQL query using this date for the charges table, it might look like this:

SELECT *

FROM stripe.charges

WHERE created >= '2015-11-11 00:00:00' /* Min. Extraction Date */

ORDER BY created

For ongoing replication jobs, Stitch will query for and extract data using the last saved maximum value in the table’s Replication Key column and the Lookback Window for the table.

Note: This applies to every replication job that takes place after the historical replication job.

Example

The last maximum saved Replication Key value for the charges table is 2017-10-01 00:00:00.

To account for the Lookback Window of 600 days, we’d subtract this from the last maximum saved Replication Key value:

2017-10-01 00:00:00 - 600 days = 2016-02-09 00:00:00

In this case, Stitch would query for and extract data that is newer than or equal to 2016-02-09 00:00:00 and older than or equal to 2017-10-01 00:00:00.

If this were a SQL query, it might look like this:

SELECT *

FROM charges

WHERE created >= '2016-02-09 00:00:00'

/* max Replication Key value - Lookback Window */

AND created <= '2017-10-01 00:00:00'

/* max Replication Key value from previous job */

ORDER BY created

Stripe table reference

Schemas and versioning

Schemas and naming conventions can change from version to version, so we recommend verifying your integration’s version before continuing.

The schema and info displayed below is for version 3 of this integration.

This is the latest version of the Stripe integration.

Table and column names in your destination

Depending on your destination, table and column names may not appear as they are outlined below.

For example: Object names are lowercased in Redshift (CusTomERs > customers), while case is maintained in PostgreSQL destinations (CusTomERs > CusTomERs). Refer to the Loading Guide for your destination for more info.

balance_transactions

The balance_transactions table contains info about transactions have have contributed to your Stripe account balance, including charges, transfers, etc.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join balance_transactions with | on |

|---|---|

| charges |

balance_transactions.id = charges.balance_transaction |

| payouts |

balance_transactions.id = payouts.balance_transaction balance_transactions.id = payouts.failure_balance_transaction |

| transfers |

balance_transactions.id = transfers.balance_transaction balance_transactions.id = transfers.failure_balance_transaction |

| disputes |

balance_transactions.id = disputes.balance_transactions.id |

|

amount INTEGER |

|||||

|

available_on INTEGER |

|||||

|

created

DATE-TIME |

|||||

|

currency STRING |

|||||

|

description STRING |

|||||

|

exchange_rate NUMBER |

|||||

|

fee INTEGER |

|||||

|

fee_details ARRAY

|

|||||

|

id

STRING |

|||||

|

net INTEGER |

|||||

|

object STRING |

|||||

|

source STRING |

|||||

|

sourced_transfers ARRAY |

|||||

|

status STRING |

|||||

|

type STRING |

|||||

|

updated DATE-TIME |

charges

The charges table contains info about charges to credit and debit cards.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join charges with | on |

|---|---|

| balance_transactions |

charges.balance_transaction = balance_transactions.id |

| payouts |

charges.balance_transaction = payouts.balance_transaction charges.balance_transaction = payouts.failure_balance_transaction |

| transfers |

charges.balance_transaction = transfers.balance_transaction charges.balance_transaction = transfers.failure_balance_transaction charges.source_transfer = transfers.id |

| disputes |

charges.balance_transaction = disputes.balance_transactions.id charges.id = disputes.charge |

| customers |

charges.card.id = customers.cards.id charges.source.id = customers.cards.id charges.customer = customers.id charges.card.customer = customers.id charges.customer = customers.cards.customer charges.card.customer = customers.cards.customer charges.customer = customers.discount.customer charges.card.customer = customers.discount.customer |

| invoices |

charges.id = invoices.charge charges.customer = invoices.customer charges.card.customer = invoices.customer charges.customer = invoices.discount.customer charges.card.customer = invoices.discount.customer charges.invoice = invoices.id |

| invoice_items |

charges.customer = invoice_items.customer charges.card.customer = invoice_items.customer charges.invoice = invoice_items.invoice |

| subscription_items |

charges.customer = subscription_items.customer charges.card.customer = subscription_items.customer |

| subscriptions |

charges.customer = subscriptions.customer charges.card.customer = subscriptions.customer |

| invoice_line_items |

charges.invoice = invoice_line_items.invoice |

|

amount INTEGER |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

amount_captured INTEGER |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

amount_refunded INTEGER |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

application STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

application_fee STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

application_fee_amount INTEGER |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

balance_transaction STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

billing_details OBJECT

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

calculated_statement_descriptor STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

captured BOOLEAN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

card OBJECT

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

created

DATE-TIME |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

currency STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

customer STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

description STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

destination STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

dispute STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

disputed BOOLEAN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

failure_code STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

failure_message STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

fraud_details OBJECT

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

id

STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

invoice STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

livemode BOOLEAN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

metadata OBJECT |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

object STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

on_behalf_of STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

order STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

outcome OBJECT

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

paid BOOLEAN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

payment_intent STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

payment_method STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

payment_method_details OBJECT

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

receipt_email STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

receipt_number STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

receipt_url STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

refunded BOOLEAN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

refunds ARRAY

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

review STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

shipping OBJECT |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

source OBJECT

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

source_transfer STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

statement_description STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

statement_descriptor STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

statement_descriptor_suffix STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

status STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

transfer_data OBJECT

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

transfer_group STRING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

updated DATE-TIME |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

updated_by_event_type STRING |

coupons

The coupons table contains info about percent or amount-off discounts that may be applied to a customer. Note: Coupons only apply to invoices; they don’t apply to one-off charges.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join coupons with | on |

|---|---|

| customers |

coupons.id = customers.discount.coupon.id |

| invoices |

coupons.id = invoices.discount.coupon.id |

| subscriptions |

coupons.id = subscriptions.discount.coupon.id |

|

amount_off INTEGER |

|

created

DATE-TIME |

|

currency STRING |

|

duration STRING |

|

duration_in_months INTEGER |

|

id

STRING |

|

livemode BOOLEAN |

|

max_redemptions INTEGER |

|

metadata OBJECT |

|

name STRING |

|

object STRING |

|

percent_off NUMBER |

|

percent_off_precise NUMBER |

|

redeem_by DATE-TIME |

|

times_redeemed INTEGER |

|

updated DATE-TIME |

|

updated_by_event_type STRING |

|

valid BOOLEAN |

customers

The customers table contains info about your customers.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join customers with | on |

|---|---|

| charges |

customers.cards.id = charges.card.id customers.cards.id = charges.source.id customers.id = charges.customer customers.cards.customer = charges.customer customers.discount.customer = charges.customer customers.id = charges.card.customer customers.cards.customer = charges.card.customer customers.discount.customer = charges.card.customer |

| coupons |

customers.discount.coupon.id = coupons.id |

| invoices |

customers.discount.coupon.id = invoices.discount.coupon.id customers.id = invoices.customer customers.cards.customer = invoices.customer customers.discount.customer = invoices.customer customers.id = invoices.discount.customer customers.cards.customer = invoices.discount.customer customers.discount.customer = invoices.discount.customer customers.subscriptions = invoices.subscription customers.discount.subscription = invoices.subscription customers.subscriptions = invoices.discount.subscription customers.discount.subscription = invoices.discount.subscription |

| subscriptions |

customers.discount.coupon.id = subscriptions.discount.coupon.id customers.id = subscriptions.customer customers.cards.customer = subscriptions.customer customers.discount.customer = subscriptions.customer customers.subscriptions = subscriptions.id customers.discount.subscription = subscriptions.id |

| invoice_items |

customers.id = invoice_items.customer customers.cards.customer = invoice_items.customer customers.discount.customer = invoice_items.customer customers.subscriptions = invoice_items.subscription customers.discount.subscription = invoice_items.subscription |

| subscription_items |

customers.id = subscription_items.customer customers.cards.customer = subscription_items.customer customers.discount.customer = subscription_items.customer customers.subscriptions = subscription_items.subscription customers.discount.subscription = subscription_items.subscription |

| invoice_line_items |

customers.subscriptions = invoice_line_items.subscription customers.discount.subscription = invoice_line_items.subscription |

|

account_balance INTEGER |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

address OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

balance INTEGER |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

cards ARRAY

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

created

DATE-TIME |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

currency STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

default_card STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

default_source STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

delinquent BOOLEAN |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

description STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

discount OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

id

STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

invoice_prefix STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

invoice_settings OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

livemode BOOLEAN |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

metadata OBJECT |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

name STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

next_invoice_sequence INTEGER |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

object STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

phone STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

preferred_locales ARRAY |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

shipping OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

sources

ARRAY

["TYPE", ["NULL", "STRING"]] |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

subscriptions ARRAY |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tax_exempt STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tax_ids

ARRAY

["TYPE", ["NULL", "STRING"]] |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tax_info STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tax_info_verification STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

updated DATE-TIME |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

updated_by_event_type STRING |

disputes

This table contains information about customer disputes related to charges on their credit card.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join disputes with | on |

|---|---|

| balance_transactions |

disputes.balance_transactions.id = balance_transactions.id |

| charges |

disputes.balance_transactions.id = charges.balance_transaction disputes.charge = charges.id |

| payouts |

disputes.balance_transactions.id = payouts.balance_transaction disputes.balance_transactions.id = payouts.failure_balance_transaction |

| transfers |

disputes.balance_transactions.id = transfers.balance_transaction disputes.balance_transactions.id = transfers.failure_balance_transaction |

| invoices |

disputes.charge = invoices.charge |

|

amount INTEGER |

|||||||||||||||||||||||||||

|

balance_transactions ARRAY

|

|||||||||||||||||||||||||||

|

charge STRING |

|||||||||||||||||||||||||||

|

created

DATE-TIME |

|||||||||||||||||||||||||||

|

currency STRING |

|||||||||||||||||||||||||||

|

evidence STRING, OBJECT

|

|||||||||||||||||||||||||||

|

evidence_details OBJECT

|

|||||||||||||||||||||||||||

|

id

STRING |

|||||||||||||||||||||||||||

|

is_charge_refundable BOOLEAN |

|||||||||||||||||||||||||||

|

livemode BOOLEAN |

|||||||||||||||||||||||||||

|

metadata OBJECT |

|||||||||||||||||||||||||||

|

object STRING |

|||||||||||||||||||||||||||

|

reason STRING |

|||||||||||||||||||||||||||

|

status STRING |

|||||||||||||||||||||||||||

|

updated DATE-TIME |

|||||||||||||||||||||||||||

|

updated_by_event_type STRING |

events

The events table contains info about events. When an event occurs, a new event object is created. This table acts as the history of an object, allowing you to see how it has changed over time.

For example: When an invoice is created, an invoice.created event is created. When the draft invoice is finalized and updated to be open, an invoice.finalized event is created. When the invoice is sent to the customer, an invoice.sent event is created.

For more info about this table and how data is replicated, refer to the Replication section. Additionally, refer to Stripe’s documentation for info about event types and the objects they describe.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

|

api_version STRING |

|

created

DATE-TIME |

|

data OBJECT |

|

id

STRING |

|

livemode BOOLEAN |

|

object STRING |

|

pending_webhooks INTEGER |

|

request STRING |

|

type STRING |

|

updated DATE-TIME |

invoice_items

The invoice_items table contains info about items contained in customer invoices.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

date |

| Useful links |

| Join invoice_items with | on |

|---|---|

| charges |

invoice_items.customer = charges.customer invoice_items.customer = charges.card.customer invoice_items.invoice = charges.invoice |

| customers |

invoice_items.customer = customers.id invoice_items.customer = customers.cards.customer invoice_items.customer = customers.discount.customer invoice_items.subscription = customers.subscriptions invoice_items.subscription = customers.discount.subscription |

| invoices |

invoice_items.customer = invoices.customer invoice_items.customer = invoices.discount.customer invoice_items.invoice = invoices.id invoice_items.subscription = invoices.subscription invoice_items.subscription = invoices.discount.subscription |

| subscription_items |

invoice_items.customer = subscription_items.customer invoice_items.plan.id = subscription_items.plan.id invoice_items.plan.product = subscription_items.plan.product invoice_items.subscription_item = subscription_items.id invoice_items.subscription = subscription_items.subscription |

| subscriptions |

invoice_items.customer = subscriptions.customer invoice_items.plan.id = subscriptions.plan.id invoice_items.plan.product = subscriptions.plan.product invoice_items.subscription_item = subscriptions.items invoice_items.subscription = subscriptions.id |

| invoice_line_items |

invoice_items.invoice = invoice_line_items.invoice invoice_items.id = invoice_line_items.invoice_item invoice_items.plan.product = invoice_line_items.plan.product invoice_items.subscription = invoice_line_items.subscription |

| plans |

invoice_items.plan.id = plans.id invoice_items.plan.product = plans.product |

| products |

invoice_items.plan.product = products.id |

|

amount INTEGER |

||||||||||||||||||||||||||||

|

currency STRING |

||||||||||||||||||||||||||||

|

customer STRING |

||||||||||||||||||||||||||||

|

date

DATE-TIME |

||||||||||||||||||||||||||||

|

description STRING |

||||||||||||||||||||||||||||

|

discountable BOOLEAN |

||||||||||||||||||||||||||||

|

discounts ARRAY |

||||||||||||||||||||||||||||

|

id

STRING |

||||||||||||||||||||||||||||

|

invoice STRING |

||||||||||||||||||||||||||||

|

livemode BOOLEAN |

||||||||||||||||||||||||||||

|

metadata OBJECT |

||||||||||||||||||||||||||||

|

object STRING |

||||||||||||||||||||||||||||

|

period OBJECT

|

||||||||||||||||||||||||||||

|

plan OBJECT

|

||||||||||||||||||||||||||||

|

proration BOOLEAN |

||||||||||||||||||||||||||||

|

quantity INTEGER |

||||||||||||||||||||||||||||

|

subscription STRING |

||||||||||||||||||||||||||||

|

subscription_item STRING |

||||||||||||||||||||||||||||

|

tax_rates ARRAY

|

||||||||||||||||||||||||||||

|

unit_amount INTEGER |

||||||||||||||||||||||||||||

|

unit_amount_decimal NUMBER |

||||||||||||||||||||||||||||

|

updated DATE-TIME |

||||||||||||||||||||||||||||

|

updated_by_event_type STRING |

invoice_line_items

The invoice_line_items table contains info about the line items contained in invoices.

Note: In order to replicate invoice line item data, the invoices table must also be set to replicate.

Invoice line item replication

To replicate invoice line items, Stitch will use the Replication Key of the corresponding invoice in the invoices table to detect new and updated records. This means that any time an invoice is updated, its associated line items will also be replicated.

For example: An invoice with five line items is updated when its status changes from draft to open. The record in invoices will be replicated, as will the records for its five line items. In this example, a total of six records will be replicated.

|

Key-based Incremental |

|

|

Primary Keys |

id invoice |

| Useful links |

| Join invoice_line_items with | on |

|---|---|

| charges |

invoice_line_items.invoice = charges.invoice |

| invoice_items |

invoice_line_items.invoice = invoice_items.invoice invoice_line_items.invoice_item = invoice_items.id invoice_line_items.plan.product = invoice_items.plan.product invoice_line_items.subscription = invoice_items.subscription |

| invoices |

invoice_line_items.invoice = invoices.id invoice_line_items.id = invoices.lines invoice_line_items.subscription = invoices.subscription invoice_line_items.subscription = invoices.discount.subscription |

| plans |

invoice_line_items.plan.product = plans.product |

| products |

invoice_line_items.plan.product = products.id |

| subscription_items |

invoice_line_items.plan.product = subscription_items.plan.product invoice_line_items.subscription = subscription_items.subscription |

| subscriptions |

invoice_line_items.plan.product = subscriptions.plan.product invoice_line_items.subscription = subscriptions.id |

| customers |

invoice_line_items.subscription = customers.subscriptions invoice_line_items.subscription = customers.discount.subscription |

|

amount INTEGER |

||||||||||||||||||||||||||||||

|

currency STRING |

||||||||||||||||||||||||||||||

|

description STRING |

||||||||||||||||||||||||||||||

|

discount_amounts ARRAY

|

||||||||||||||||||||||||||||||

|

discountable BOOLEAN |

||||||||||||||||||||||||||||||

|

discounts ARRAY |

||||||||||||||||||||||||||||||

|

id

STRING |

||||||||||||||||||||||||||||||

|

invoice

STRING |

||||||||||||||||||||||||||||||

|

invoice_item STRING |

||||||||||||||||||||||||||||||

|

livemode BOOLEAN |

||||||||||||||||||||||||||||||

|

metadata OBJECT |

||||||||||||||||||||||||||||||

|

object STRING |

||||||||||||||||||||||||||||||

|

period OBJECT

|

||||||||||||||||||||||||||||||

|

plan OBJECT

|

||||||||||||||||||||||||||||||

|

price OBJECT

|

||||||||||||||||||||||||||||||

|

proration BOOLEAN |

||||||||||||||||||||||||||||||

|

proration_details OBJECT |

||||||||||||||||||||||||||||||

|

quantity INTEGER |

||||||||||||||||||||||||||||||

|

subscription STRING |

||||||||||||||||||||||||||||||

|

subscription_item STRING |

||||||||||||||||||||||||||||||

|

tax_amounts ARRAY

|

||||||||||||||||||||||||||||||

|

tax_rates ARRAY

|

||||||||||||||||||||||||||||||

|

type STRING |

invoices

The invoices table contains info about invoices. Invoices are statements of amounts owed by customers, which can be one-off charges or generated periodically from a subscription.

Invoice line items

Full records for the line items associated with an invoice can be found in the invoice_line_items table. To replicate these records, you must set this table and the invoice_line_items table to replicate.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join invoices with | on |

|---|---|

| charges |

invoices.charge = charges.id invoices.customer = charges.customer invoices.discount.customer = charges.customer invoices.customer = charges.card.customer invoices.discount.customer = charges.card.customer invoices.id = charges.invoice |

| disputes |

invoices.charge = disputes.charge |

| coupons |

invoices.discount.coupon.id = coupons.id |

| customers |

invoices.discount.coupon.id = customers.discount.coupon.id invoices.customer = customers.id invoices.discount.customer = customers.id invoices.customer = customers.cards.customer invoices.discount.customer = customers.cards.customer invoices.customer = customers.discount.customer invoices.discount.customer = customers.discount.customer invoices.subscription = customers.subscriptions invoices.discount.subscription = customers.subscriptions invoices.subscription = customers.discount.subscription invoices.discount.subscription = customers.discount.subscription |

| subscriptions |

invoices.discount.coupon.id = subscriptions.discount.coupon.id invoices.customer = subscriptions.customer invoices.discount.customer = subscriptions.customer invoices.subscription = subscriptions.id invoices.discount.subscription = subscriptions.id |

| invoice_items |

invoices.customer = invoice_items.customer invoices.discount.customer = invoice_items.customer invoices.id = invoice_items.invoice invoices.subscription = invoice_items.subscription invoices.discount.subscription = invoice_items.subscription |

| subscription_items |

invoices.customer = subscription_items.customer invoices.discount.customer = subscription_items.customer invoices.subscription = subscription_items.subscription invoices.discount.subscription = subscription_items.subscription |

| invoice_line_items |

invoices.id = invoice_line_items.invoice invoices.lines = invoice_line_items.id invoices.subscription = invoice_line_items.subscription invoices.discount.subscription = invoice_line_items.subscription |

|

account_country STRING |

|||||||||||||||||||||||||||

|

account_name STRING |

|||||||||||||||||||||||||||

|

account_tax_ids ARRAY |

|||||||||||||||||||||||||||

|

amount_due INTEGER |

|||||||||||||||||||||||||||

|

amount_paid INTEGER |

|||||||||||||||||||||||||||

|

amount_remaining INTEGER |

|||||||||||||||||||||||||||

|

application_fee INTEGER |

|||||||||||||||||||||||||||

|

application_fee_amount INTEGER |

|||||||||||||||||||||||||||

|

attempt_count INTEGER |

|||||||||||||||||||||||||||

|

attempted BOOLEAN |

|||||||||||||||||||||||||||

|

auto_advance BOOLEAN |

|||||||||||||||||||||||||||

|

automatic_tax OBJECT

|

|||||||||||||||||||||||||||

|

billing STRING |

|||||||||||||||||||||||||||

|

billing_reason STRING |

|||||||||||||||||||||||||||

|

charge STRING |

|||||||||||||||||||||||||||

|

closed BOOLEAN |

|||||||||||||||||||||||||||

|

collection_method STRING |

|||||||||||||||||||||||||||

|

created

DATE-TIME |

|||||||||||||||||||||||||||

|

currency STRING |

|||||||||||||||||||||||||||

|

custom_fields ARRAY

|

|||||||||||||||||||||||||||

|

customer STRING |

|||||||||||||||||||||||||||

|

customer_address OBJECT

|

|||||||||||||||||||||||||||

|

customer_email STRING |

|||||||||||||||||||||||||||

|

customer_name STRING |

|||||||||||||||||||||||||||

|

customer_phone STRING |

|||||||||||||||||||||||||||

|

customer_shipping OBJECT

|

|||||||||||||||||||||||||||

|

customer_tax_exempt STRING |

|||||||||||||||||||||||||||

|

customer_tax_ids ARRAY

|

|||||||||||||||||||||||||||

|

date DATE-TIME |

|||||||||||||||||||||||||||

|

default_payment_method STRING |

|||||||||||||||||||||||||||

|

default_source STRING |

|||||||||||||||||||||||||||

|

default_tax_rates ARRAY

|

|||||||||||||||||||||||||||

|

description STRING |

|||||||||||||||||||||||||||

|

discount OBJECT

|

|||||||||||||||||||||||||||

|

discounts ARRAY |

|||||||||||||||||||||||||||

|

due_date DATE-TIME |

|||||||||||||||||||||||||||

|

ending_balance INTEGER |

|||||||||||||||||||||||||||

|

finalized_at DATE-TIME |

|||||||||||||||||||||||||||

|

footer STRING |

|||||||||||||||||||||||||||

|

forgiven BOOLEAN |

|||||||||||||||||||||||||||

|

hosted_invoice_url STRING |

|||||||||||||||||||||||||||

|

id

STRING |

|||||||||||||||||||||||||||

|

invoice_pdf STRING |

|||||||||||||||||||||||||||

|

last_finalization_error OBJECT

|

|||||||||||||||||||||||||||

|

lines ARRAY, OBJECT |

|||||||||||||||||||||||||||

|

livemode BOOLEAN |

|||||||||||||||||||||||||||

|

metadata OBJECT |

|||||||||||||||||||||||||||

|

next_payment_attempt DATE-TIME |

|||||||||||||||||||||||||||

|

number STRING |

|||||||||||||||||||||||||||

|

object STRING |

|||||||||||||||||||||||||||

|

on_behalf_of STRING, OBJECT |

|||||||||||||||||||||||||||

|

paid BOOLEAN |

|||||||||||||||||||||||||||

|

paid_out_of_band BOOLEAN |

|||||||||||||||||||||||||||

|

payment STRING |

|||||||||||||||||||||||||||

|

payment_intent STRING |

|||||||||||||||||||||||||||

|

payment_settings OBJECT

|

|||||||||||||||||||||||||||

|

period_end DATE-TIME |

|||||||||||||||||||||||||||

|

period_start DATE-TIME |

|||||||||||||||||||||||||||

|

post_payment_credit_notes_amount INTEGER |

|||||||||||||||||||||||||||

|

pre_payment_credit_notes_amount INTEGER |

|||||||||||||||||||||||||||

|

quote OBJECT, STRING |

|||||||||||||||||||||||||||

|

receipt_number STRING |

|||||||||||||||||||||||||||

|

starting_balance INTEGER |

|||||||||||||||||||||||||||

|

statement_description STRING |

|||||||||||||||||||||||||||

|

statement_descriptor STRING |

|||||||||||||||||||||||||||

|

status STRING |

|||||||||||||||||||||||||||

|

status_transitions OBJECT

|

|||||||||||||||||||||||||||

|

subscription STRING |

|||||||||||||||||||||||||||

|

subscription_details OBJECT

|

|||||||||||||||||||||||||||

|

subtotal INTEGER |

|||||||||||||||||||||||||||

|

tax INTEGER |

|||||||||||||||||||||||||||

|

tax_percent NUMBER |

|||||||||||||||||||||||||||

|

total INTEGER |

|||||||||||||||||||||||||||

|

total_discount_amounts ARRAY

|

|||||||||||||||||||||||||||

|

total_tax_amounts ARRAY

|

|||||||||||||||||||||||||||

|

transfer_data OBJECT

|

|||||||||||||||||||||||||||

|

updated DATE-TIME |

|||||||||||||||||||||||||||

|

updated_by_event_type STRING |

|||||||||||||||||||||||||||

|

webhooks_delivered_at DATE-TIME |

payment_intents

This table contains information about payments, from creation through checkout, in your Stripe account.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

|

amount INTEGER |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

amount_capturable INTEGER |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

amount_received INTEGER |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

application STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

application_fee_amount INTEGER |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

automatic_payment_methods OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

canceled_at DATE-TIME |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

cancellation_reason STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

capture_method STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

client_secret STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

confirmation_method STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

created

DATE-TIME |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

currency STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

customer STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

description STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

id

STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

invoice STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

last_payment_error OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

latest_charge STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

livemode BOOLEAN |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

metadata OBJECT |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

next_action OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

object STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

on_behalf_of STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

payment_method STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

payment_method_options OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

payment_method_types ARRAY |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

processing OBJECT |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

receipt_email STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

review STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

setup_future_usage STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

shipping OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

source STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

statement_descriptor STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

statement_descriptor_suffix STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

status STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

transfer_data OBJECT

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

transfer_group STRING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

updated DATE-TIME |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

updated_by_event_type STRING |

payout_transactions

This table contains info about payout transactions.

|

Full Table |

|

|

Primary Key |

id |

| Useful links |

| Join payout_transactions with | on |

|---|---|

| payouts |

payout_transactions.payout_id = payouts.id |

|

id

STRING |

|

payout_id STRING |

payouts

The payouts table contains info about payouts, which occur when you receive funds from Stripe or initiate a payout to a bank account of the debit card of a connected Stripe account.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join payouts with | on |

|---|---|

| balance_transactions |

payouts.balance_transaction = balance_transactions.id payouts.failure_balance_transaction = balance_transactions.id |

| charges |

payouts.balance_transaction = charges.balance_transaction payouts.failure_balance_transaction = charges.balance_transaction |

| transfers |

payouts.balance_transaction = transfers.balance_transaction payouts.failure_balance_transaction = transfers.balance_transaction payouts.balance_transaction = transfers.failure_balance_transaction payouts.failure_balance_transaction = transfers.failure_balance_transaction |

| disputes |

payouts.balance_transaction = disputes.balance_transactions.id payouts.failure_balance_transaction = disputes.balance_transactions.id |

| payout_transactions |

payouts.id = payout_transactions.payout_id |

|

amount INTEGER |

|||||||||||||

|

amount_reversed INTEGER |

|||||||||||||

|

arrival_date DATE-TIME |

|||||||||||||

|

automatic BOOLEAN |

|||||||||||||

|

balance_transaction STRING |

|||||||||||||

|

bank_account OBJECT

|

|||||||||||||

|

created

DATE-TIME |

|||||||||||||

|

currency STRING |

|||||||||||||

|

date DATE-TIME |

|||||||||||||

|

description STRING |

|||||||||||||

|

destination STRING |

|||||||||||||

|

failure_balance_transaction STRING |

|||||||||||||

|

failure_code STRING |

|||||||||||||

|

failure_message STRING |

|||||||||||||

|

id

STRING |

|||||||||||||

|

livemode BOOLEAN |

|||||||||||||

|

metadata OBJECT |

|||||||||||||

|

method STRING |

|||||||||||||

|

object STRING |

|||||||||||||

|

original_payout STRING |

|||||||||||||

|

recipient STRING |

|||||||||||||

|

reversed_by STRING |

|||||||||||||

|

source_transaction STRING |

|||||||||||||

|

source_type STRING |

|||||||||||||

|

statement_description STRING |

|||||||||||||

|

statement_descriptor STRING |

|||||||||||||

|

status STRING |

|||||||||||||

|

transfer_group STRING |

|||||||||||||

|

type STRING |

|||||||||||||

|

updated DATE-TIME |

|||||||||||||

|

updated_by_event_type STRING |

plans

The plans table contains info about the plans in your Stripe account. A plan defines the base price, currency, and billing cycle for subscriptions.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join plans with | on |

|---|---|

| invoice_items |

plans.id = invoice_items.plan.id plans.product = invoice_items.plan.product |

| subscription_items |

plans.id = subscription_items.plan.id plans.product = subscription_items.plan.product |

| subscriptions |

plans.id = subscriptions.plan.id plans.product = subscriptions.plan.product |

| invoice_line_items |

plans.product = invoice_line_items.plan.product |

| products |

plans.product = products.id |

|

active BOOLEAN |

|||

|

aggregate_usage STRING |

|||

|

amount INTEGER |

|||

|

amount_decimal NUMBER |

|||

|

billing_scheme STRING |

|||

|

created

DATE-TIME |

|||

|

currency STRING |

|||

|

id

STRING |

|||

|

interval STRING |

|||

|

interval_count INTEGER |

|||

|

livemode BOOLEAN |

|||

|

metadata OBJECT |

|||

|

name STRING |

|||

|

nickname STRING |

|||

|

object STRING |

|||

|

product STRING |

|||

|

statement_description STRING |

|||

|

statement_descriptor STRING |

|||

|

tiers ARRAY

|

|||

|

tiers_mode STRING |

|||

|

transform_usage OBJECT |

|||

|

trial_period_days INTEGER |

|||

|

updated DATE-TIME |

|||

|

updated_by_event_type STRING |

|||

|

usage_type STRING |

products

The products table contains info about the products in your Stripe account.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join products with | on |

|---|---|

| invoice_items |

products.id = invoice_items.plan.product |

| invoice_line_items |

products.id = invoice_line_items.plan.product |

| plans |

products.id = plans.product |

| subscription_items |

products.id = subscription_items.plan.product |

| subscriptions |

products.id = subscriptions.plan.product |

|

active BOOLEAN |

||||

|

attributes ARRAY |

||||

|

caption STRING |

||||

|

created

DATE-TIME |

||||

|

deactivate_on ARRAY |

||||

|

description STRING |

||||

|

id

STRING |

||||

|

images ARRAY |

||||

|

livemode BOOLEAN |

||||

|

metadata OBJECT |

||||

|

name STRING |

||||

|

object STRING |

||||

|

package_dimensions OBJECT

|

||||

|

shippable BOOLEAN |

||||

|

statement_descriptor STRING |

||||

|

tax_code STRING |

||||

|

type STRING |

||||

|

unit_label STRING |

||||

|

updated DATE-TIME |

||||

|

updated_by_event_type STRING |

||||

|

url STRING |

subscription_items

The subscription_items table contains info about subscription items. In Stripe, subscription items are used to create customer subscriptions with more than one plan.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join subscription_items with | on |

|---|---|

| charges |

subscription_items.customer = charges.customer subscription_items.customer = charges.card.customer |

| customers |

subscription_items.customer = customers.id subscription_items.customer = customers.cards.customer subscription_items.customer = customers.discount.customer subscription_items.subscription = customers.subscriptions subscription_items.subscription = customers.discount.subscription |

| invoice_items |

subscription_items.customer = invoice_items.customer subscription_items.plan.id = invoice_items.plan.id subscription_items.plan.product = invoice_items.plan.product subscription_items.id = invoice_items.subscription_item subscription_items.subscription = invoice_items.subscription |

| invoices |

subscription_items.customer = invoices.customer subscription_items.customer = invoices.discount.customer subscription_items.subscription = invoices.subscription subscription_items.subscription = invoices.discount.subscription |

| subscriptions |

subscription_items.customer = subscriptions.customer subscription_items.plan.id = subscriptions.plan.id subscription_items.plan.product = subscriptions.plan.product subscription_items.id = subscriptions.items subscription_items.subscription = subscriptions.id |

| plans |

subscription_items.plan.id = plans.id subscription_items.plan.product = plans.product |

| invoice_line_items |

subscription_items.plan.product = invoice_line_items.plan.product subscription_items.subscription = invoice_line_items.subscription |

| products |

subscription_items.plan.product = products.id |

|

application_fee_percent NUMBER |

||||||||||||||||||||||||||||||

|

billing_thresholds OBJECT

|

||||||||||||||||||||||||||||||

|

cancel_at_period_end BOOLEAN |

||||||||||||||||||||||||||||||

|

canceled_at DATE-TIME |

||||||||||||||||||||||||||||||

|

created

DATE-TIME |

||||||||||||||||||||||||||||||

|

current_period_end DATE-TIME |

||||||||||||||||||||||||||||||

|

current_period_start DATE-TIME |

||||||||||||||||||||||||||||||

|

customer STRING |

||||||||||||||||||||||||||||||

|

discount OBJECT |

||||||||||||||||||||||||||||||

|

ended_at DATE-TIME |

||||||||||||||||||||||||||||||

|

id

STRING |

||||||||||||||||||||||||||||||

|

livemode BOOLEAN |

||||||||||||||||||||||||||||||

|

metadata OBJECT |

||||||||||||||||||||||||||||||

|

object STRING |

||||||||||||||||||||||||||||||

|

plan OBJECT

|

||||||||||||||||||||||||||||||

|

price OBJECT

|

||||||||||||||||||||||||||||||

|

quantity INTEGER |

||||||||||||||||||||||||||||||

|

start DATE-TIME |

||||||||||||||||||||||||||||||

|

status STRING |

||||||||||||||||||||||||||||||

|

subscription STRING |

||||||||||||||||||||||||||||||

|

tax_percent NUMBER |

||||||||||||||||||||||||||||||

|

tax_rates ARRAY

|

||||||||||||||||||||||||||||||

|

trial_end DATE-TIME |

||||||||||||||||||||||||||||||

|

trial_start DATE-TIME |

subscriptions

The subscriptions table contains info about subscriptions, which allow you to charge a customer on a recurring basis. A subscription ties a customer to a particular plan.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join subscriptions with | on |

|---|---|

| coupons |

subscriptions.discount.coupon.id = coupons.id |

| customers |

subscriptions.discount.coupon.id = customers.discount.coupon.id subscriptions.customer = customers.id subscriptions.customer = customers.cards.customer subscriptions.customer = customers.discount.customer subscriptions.id = customers.subscriptions subscriptions.id = customers.discount.subscription |

| invoices |

subscriptions.discount.coupon.id = invoices.discount.coupon.id subscriptions.customer = invoices.customer subscriptions.customer = invoices.discount.customer subscriptions.id = invoices.subscription subscriptions.id = invoices.discount.subscription |

| charges |

subscriptions.customer = charges.customer subscriptions.customer = charges.card.customer |

| invoice_items |

subscriptions.customer = invoice_items.customer subscriptions.plan.id = invoice_items.plan.id subscriptions.plan.product = invoice_items.plan.product subscriptions.items = invoice_items.subscription_item subscriptions.id = invoice_items.subscription |

| subscription_items |

subscriptions.customer = subscription_items.customer subscriptions.plan.id = subscription_items.plan.id subscriptions.plan.product = subscription_items.plan.product subscriptions.items = subscription_items.id subscriptions.id = subscription_items.subscription |

| plans |

subscriptions.plan.id = plans.id subscriptions.plan.product = plans.product |

| invoice_line_items |

subscriptions.plan.product = invoice_line_items.plan.product subscriptions.id = invoice_line_items.subscription |

| products |

subscriptions.plan.product = products.id |

|

application_fee_percent NUMBER |

|||||||||||||||||||||||||||

|

billing STRING |

|||||||||||||||||||||||||||

|

billing_cycle_anchor DATE-TIME |

|||||||||||||||||||||||||||

|

billing_thresholds OBJECT

|

|||||||||||||||||||||||||||

|

cancel_at DATE-TIME |

|||||||||||||||||||||||||||

|

cancel_at_period_end BOOLEAN |

|||||||||||||||||||||||||||

|

canceled_at DATE-TIME |

|||||||||||||||||||||||||||

|

collection_method STRING |

|||||||||||||||||||||||||||

|

created

DATE-TIME |

|||||||||||||||||||||||||||

|

current_period_end DATE-TIME |

|||||||||||||||||||||||||||

|

current_period_start DATE-TIME |

|||||||||||||||||||||||||||

|

customer STRING |

|||||||||||||||||||||||||||

|

days_until_due INTEGER |

|||||||||||||||||||||||||||

|

default_payment_method STRING |

|||||||||||||||||||||||||||

|

default_source STRING |

|||||||||||||||||||||||||||

|

discount OBJECT

|

|||||||||||||||||||||||||||

|

ended_at DATE-TIME |

|||||||||||||||||||||||||||

|

id

STRING |

|||||||||||||||||||||||||||

|

invoice_customer_balance_settings OBJECT

|

|||||||||||||||||||||||||||

|

items ARRAY |

|||||||||||||||||||||||||||

|

latest_invoice STRING |

|||||||||||||||||||||||||||

|

livemode BOOLEAN |

|||||||||||||||||||||||||||

|

metadata OBJECT |

|||||||||||||||||||||||||||

|

next_pending_invoice_item_invoice DATE-TIME |

|||||||||||||||||||||||||||

|

object STRING |

|||||||||||||||||||||||||||

|

pause_collection OBJECT

|

|||||||||||||||||||||||||||

|

pending_invoice_item_interval OBJECT

|

|||||||||||||||||||||||||||

|

pending_setup_intent STRING |

|||||||||||||||||||||||||||

|

plan OBJECT

|

|||||||||||||||||||||||||||

|

quantity INTEGER |

|||||||||||||||||||||||||||

|

schedule STRING |

|||||||||||||||||||||||||||

|

start DATE-TIME |

|||||||||||||||||||||||||||

|

start_date DATE-TIME |

|||||||||||||||||||||||||||

|

status STRING |

|||||||||||||||||||||||||||

|

tax_percent NUMBER |

|||||||||||||||||||||||||||

|

transfer_data OBJECT

|

|||||||||||||||||||||||||||

|

trial_end DATE-TIME |

|||||||||||||||||||||||||||

|

trial_start DATE-TIME |

|||||||||||||||||||||||||||

|

updated DATE-TIME |

|||||||||||||||||||||||||||

|

updated_by_event_type STRING |

transfers

The transfers table contains info about transfers sent to connected accounts.

|

Key-based Incremental |

|

|

Primary Key |

id |

|

Replication Key |

created |

| Useful links |

| Join transfers with | on |

|---|---|

| balance_transactions |

transfers.balance_transaction = balance_transactions.id transfers.failure_balance_transaction = balance_transactions.id |

| charges |

transfers.balance_transaction = charges.balance_transaction transfers.failure_balance_transaction = charges.balance_transaction transfers.id = charges.source_transfer |

| payouts |

transfers.balance_transaction = payouts.balance_transaction transfers.failure_balance_transaction = payouts.balance_transaction transfers.balance_transaction = payouts.failure_balance_transaction transfers.failure_balance_transaction = payouts.failure_balance_transaction |

| disputes |

transfers.balance_transaction = disputes.balance_transactions.id transfers.failure_balance_transaction = disputes.balance_transactions.id |

|

amount INTEGER |

|

amount_reversed INTEGER |

|

arrival_date DATE-TIME |

|

automatic BOOLEAN |

|

balance_transaction STRING |

|

created

DATE-TIME |

|

currency STRING |

|

date DATE-TIME |

|

description STRING |

|

destination STRING |

|

failure_balance_transaction STRING |

|

id

STRING |

|

livemode BOOLEAN |

|

metadata OBJECT |

|

object STRING |

|

recipient STRING |

|

reversals ARRAY |

|

reversed BOOLEAN |

|

source_transaction STRING |

|

source_type STRING |

|

statement_description STRING |

|

statement_descriptor STRING |

|

transfer_group STRING |

|

updated DATE-TIME |

|

updated_by_event_type STRING |

| Related | Troubleshooting |

Questions? Feedback?

Did this article help? If you have questions or feedback, feel free to submit a pull request with your suggestions, open an issue on GitHub, or reach out to us.